Beside the veritable thinking you should search for a tree clearing affiliation that is fine, fit and ensured monetarily. Though a lot of organizations are open, not really they for the most part played out the best on their work. Really, every tree administration organization cannot try not to work their work faultlessly. Furthermore, shockingly, it is moreover extreme to get the tree care provider given a hand to you.

Tree overseeing administration

Expecting that fostering your own home plants, you truly need to have them pruned astonishingly every 2 to 3 years. Likewise, some perhaps require overseeing yearly. A specialist of tree pruning will obviously excuse obstructing members. Bug invasions, parasites, defilements and moreover other exhortation signs related with contamination will be seen by these people. It is incredibly trying so that you might be able to see those incidental effects yourself for the clarification that a lot of trees have signs which appear, apparently, to be slight and moreover cannot find out positively, they might be masking and besides spreading to various plants. The veritable performs of tree pruning associations are normally tree overseeing and tree making due. A couple of other explicit commitments can in like manner be given by a gigantic number of tree administration ventures for example clearing following cutting connection and cutting up and moreover planning encouraging.

Tree removal administration

Your continuous plants may be debased infections and dried out. Maybe, there exists a tree near your home creating hazardously. Beside your reasoning, you should know the way that tree removal is crucial to work carefully contemplating that it is an extremely risky action. Right when you move trees out of your place, the state of them could fundamentally influence your normal wellbeing measures, and expecting you wish to move your tree, should require support from a specialist predominantly in light of the fact that when something happens horrible, it could hurt your home and moreover proprietorship.

There are more bright lights on the killing tree that is wiped out or perhaps near your place. At the point when you shift a polluted or dried out tree, the crippled branches get risk to break and moreover drop at the hour of moving and navigate to this web-site https://treesurgeon-wilmslow.co.uk/. The veritable hardest piece of tree departures might be excusing stumps and moreover the root establishment that is unquestionably on the grounds that for straightening out in the correct way for this genuinely hard task or using a specific tree expert association helped you. So when you choose to require explicit assistance, you ought to make certain about referencing for an appraisal before the work completes.

As you focus on your breath,

As you focus on your breath,

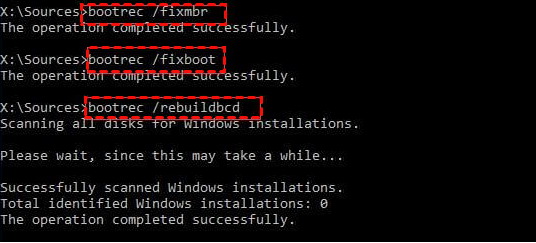

If the troubleshooter does not resolve the issue, consider restarting your computer. Often, a simple reboot can clear temporary files or processes that may be interfering with the update process. After rebooting, attempt to run the update again to see if the problem persists. If the updates still fail, you may need to reset the Windows Update components manually. This process involves stopping the Windows Update services, deleting the temporary files in the Software Distribution folder, and then restarting the services. This can be done through Command Prompt with administrative privileges, using commands like net stop wuauserv, net stop crypts, net stop bits, and net stop miserere, followed by commands to delete files and restart the services. Another effective method is to check for system file corruption using the System File Checker SFC tool. Open Command Prompt as an administrator and run the command sec /scan now. This tool will scan your system for any corrupted files and attempt to repair them.

If the troubleshooter does not resolve the issue, consider restarting your computer. Often, a simple reboot can clear temporary files or processes that may be interfering with the update process. After rebooting, attempt to run the update again to see if the problem persists. If the updates still fail, you may need to reset the Windows Update components manually. This process involves stopping the Windows Update services, deleting the temporary files in the Software Distribution folder, and then restarting the services. This can be done through Command Prompt with administrative privileges, using commands like net stop wuauserv, net stop crypts, net stop bits, and net stop miserere, followed by commands to delete files and restart the services. Another effective method is to check for system file corruption using the System File Checker SFC tool. Open Command Prompt as an administrator and run the command sec /scan now. This tool will scan your system for any corrupted files and attempt to repair them.

THCA also shows promise as a neuroprotective agent. Preliminary studies have indicated that this compound may help protect brain cells from degeneration, potentially slowing the progression of neurodegenerative diseases such as Alzheimer’s and Parkinson’s. As more research unfolds, the role of THCA in brain health could provide a significant breakthrough in natural treatments for cognitive decline and dementia. This neuroprotective potential aligns perfectly with the principles of holistic health, which emphasize prevention and supporting the body’s natural ability to heal and maintain balance. Another area where THCA flower shines is its potential anti-nausea and appetite-stimulating effects. Many individuals undergoing treatments like chemotherapy experience debilitating nausea and loss of appetite. Conventional pharmaceuticals to address these symptoms may have their own set of side effects, which can be harsh on the body. The

THCA also shows promise as a neuroprotective agent. Preliminary studies have indicated that this compound may help protect brain cells from degeneration, potentially slowing the progression of neurodegenerative diseases such as Alzheimer’s and Parkinson’s. As more research unfolds, the role of THCA in brain health could provide a significant breakthrough in natural treatments for cognitive decline and dementia. This neuroprotective potential aligns perfectly with the principles of holistic health, which emphasize prevention and supporting the body’s natural ability to heal and maintain balance. Another area where THCA flower shines is its potential anti-nausea and appetite-stimulating effects. Many individuals undergoing treatments like chemotherapy experience debilitating nausea and loss of appetite. Conventional pharmaceuticals to address these symptoms may have their own set of side effects, which can be harsh on the body. The